Forex Trading Plans

Contents:

You should also understand that the actual return could be less or your Forex trading investment will yield a loss. Invest only the money that you can lose without suffering. You must not use borrowed money in Forex trading, I mean bank loans, you can use leveraged Forex trades or debt derivatives. In case of deviation from the planned strategy or target reevaluation, you should develop an extended plan.

If you’re a novice, it makes sense to first get to grips with the basics of https://trading-market.org/. Once you’ve built up your understanding of the fundamental markets and instruments, you can begin to create your trading plan in accordance with what you’ve learned. Once you have determined that trading is a viable way for you to use your money to make profits, you are able to go live and start trading in a funded account. This makes up the most important part, where following your trading rules will translate into hard cash profits. Many traders use a decision tree schematic diagram incorporating their trading plan’s rules to assist them in making prompt trading decisions. Time really is money when it comes to trading forex, so you will need to be fully prepared to understand your trading plan’s signals and execute them quickly when they arise.

Let’s also imagine the trader doesn’t want to lose more than $3,000 of their $150,000 on this trade. If we divide that amount by 223 shares, that means the trader can tolerate a drop of $13.45 per share ($3,000 ÷ 223). Subtracting that amount from the stock’s current price, gives the trader a target stop price of $53.55 ($67 – $13.45). The trader may never have to use this stop order, but at least it’s in place if the trade moves the wrong way. Swing traderstarget trades that can be completed in a few days to a few weeks.

If the 3R rule has been followed, there will be time to think about what went wrong and to look at the market objectively again, instead of having skewed perceptions. Any strategic plan needs to have a set of outcomes to achieve. By setting these goals and preparing yourself with risk management in place, the process of following the plan becomes clearer. Having a trading plan also allows an individual to track whether there have been improvements made. After each analysis of the trader’s performance, they can discover where things went right or wrong.

Forex Investment Plan FAQs

These https://forexaggregator.com/ are not specifically designed for forex markets but are rather general strategies that can be applied to all financial markets. The strategy you decide on will correlate to the type of trader you are. Open an account to start practising your forex trading strategies via spread bets and CFDs. Just about every consistently profitable forex trader uses a trade plan and trading rules and follows them in a disciplined way. Read more about the importance of a trading plan here. Accordingly, this successful trading mindset represents a key forex trading guide post that you will want to emulate as you grow as a forex trader.

You would not simply start with buying the bricks and cement without having the correct foundations laid and knowing very well before you enter how much money you have to spend on the house. Outline the emotions you go through during every trading decision you make. Write them down and learn how to expect and control them. Make conclusions of all your trades and determine what needs to be enhanced, and what areas you will need to improve or adjust.

The difference between a trading plan and a trading system

Forex trading strategies involve analysis of the market to determine the best entry and exit points, as well as position size and trade timing. Additionally, it can involve technical indicators, which a trader will use to try and forecast future market performance. A professional trader’s strategy often includes elements from different types of analysis and a wide variety of trading methods, depending on their goals and objectives. See our simple day trading strategies for ways to trade markets if you’re new to trading. The following forex trading strategies are utilised by traders to provide structure to their trading efforts.

How to Create a Trading Plan That’s Right for You – FXCM

How to Create a Trading Plan That’s Right for You.

Posted: Fri, 09 Dec 2022 08:00:00 GMT [source]

Once your situation is in order, focus on building repetitive habits that allow you to confront the markets in the same way, from the same angle, each day. This will allow you to obtain meaningful statistics that can tell you what needs improving and what is working well. Usually, having clear rules to abide by will assist in making rational decisions. With all this said and done, it’s time to get our hands dirty and build a trading system from the ground up.

You can find more about this in the review “How much do Forex traders make per month?”. Except for one − the manager set a goal to receive 1% of profit for each trading day with minimal risks. The trader did not advertise himself; he did not communicate at forums; did not give comments and did not explain his actions. This project was unpopular among investors, trading conditions were regarded as unprofitable, the trader was considered ambitious, inexperienced or simply lazy. In the general rating of broker trading account did not rise above 25 positions.

You are unable to access tradersunion.com

Many traders have a market mantra they repeat before the day begins to get them ready. Additionally, your trading area should be free of distractions. Remember, this is a business and distractions can be costly. Trading is a business, so you have to treat it as such if you want to succeed. Reading a few books, buying a charting program, opening a brokerage account, and starting to trade with real money is not a business plan—it is more like a recipe for disaster.

The most patient traders may choose the forex position trading, which is less concerned with short-term market fluctuations and instead focuses on the long term. Position traders will hold forex positions for several weeks, months, or even years. The aim of this strategy is that the currency pair’s value would appreciate over a long-term period. When choosing a forex trading strategy, it helps to be aware of what type of trader you are and what types of strategies exist. However, it is not as simple as selecting a single trading strategy, as traders can choose to employ a single strategy or combine several.

Besides, you will experience long streaks of losses in Forex trading. In order to evaluate how much ending rate of return you can reasonably expect, you need to know your gain/loss ratio. But the fact remains that backtesting is the only way to estimate whether a technique that appeals to you will actually work on your currency pair in your timeframe.

How profitable are your trades?

Everyone is different, but I haven’t met a https://forexarena.net/r yet who didn’t need some time away from the market after a winning or losing trade. How will you enter the trading strategies that you previously defined in your trading plan? For example if one of your trading strategies is the pin bar, what entry method will you use?

Instead of doing Forex as a gambling, you could do it as a business , if you plan your actions perfectly. Despite inflation in Japan reaching a 40-year high, Japanese interest rates have remained unchanged, causing the yen to weaken considerably over the past year. The final objective of your trading plan is to obtain a comfortable situation from which to trade with as little pressure as possible. Becoming a consistent trader is more like a marathon, rather than a sprint. What markets will you trade with the system and why are these markets ideal? For example, forex and commodities tend to trend more than stocks and so might be a better choice for a trend system.

Choosing a Currency Pair

The aim is to profit from the difference in interest rates or the “interest rate differential” between the two foreign currencies. On a profitable trading day, stop when your daily targets are achieved. In relation to this, your success ratio must be considered as well. Your success ratio is your number of winning trades in proportion to the number of losing trades. Because sticking to a trading plan can be so difficult, we developed a guide and template that will help you establish a plan and will lay the groundwork for you to build your own strategy. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion.

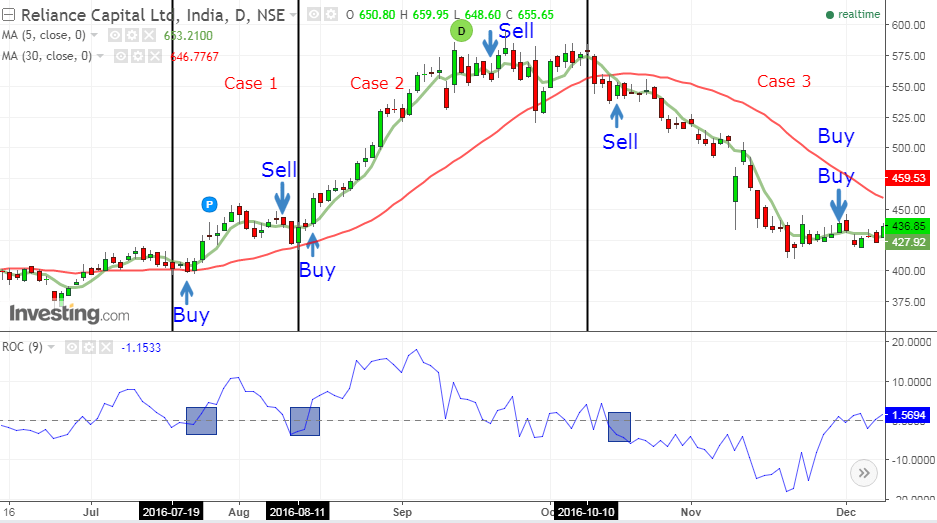

The figure below will help you on the way of creating a trading plan. Before we continue, we have to quickly distinguish the difference between a trading plan and a trading system. A trading plan removes any bad decision-making in the heat of the moment. It’s an essential tool when reviewing your trading with your accountability partner. Remember to select someone close to you must be completely transparent with them or you’re only cheating yourself.

- Moreover, if your trading plan is based on technical indicators, you can make it an algorithmic trading strategy.

- Once you have developed a strategy you can identify patterns in the markets, and test your strategies effectiveness.

- You would not simply start with buying the bricks and cement without having the correct foundations laid and knowing very well before you enter how much money you have to spend on the house.

- If you didn’t make any mistakes and the market acted less predictably, then just have a cup of tea or coffee and relax.

- Access TradingView charts with over 80 indicators, Reuters news feeds, behavioural science technology and much more.

- Even then the task to write a trading plan often falls into the category of, “I’ll get to it when I have time”.

It is speculative trading using the most liquid assets that are moderately volatile with tight spreads. Which Forex trading asset best suits your personal preferences. Consider volatility level, spread, need for leverage, etc.